In a recent development, Intuit has announced that it will discontinue its personal finance app, Mint, in January. This news has sent shockwaves through the fintech industry, with some startups seeing an opportunity to capitalize on the situation. One such startup is Monarch Money, a subscription-based money manager app co-founded by Val Agostino, Jon Sutherland, and Ozzie Osman.

A Brief History of Mint and Its Acquisition

Mint was founded in 2006 and quickly gained popularity as a free personal finance app that allowed users to track their spending, create budgets, and receive financial recommendations. In 2010, Intuit acquired Mint for $170 million, integrating its features into the company’s existing suite of financial management tools.

However, under Intuit’s ownership, Mint’s development seemed to slow down. According to a report by Fast Company, Mint’s user growth stalled, and the app’s features became less comprehensive compared to other personal finance apps on the market.

Monarch Money: The Alternative to Mint

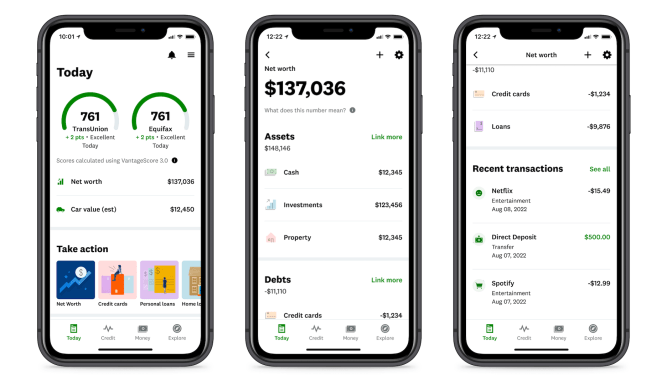

Monarch Money is a relatively new player in the fintech space, but it has already gained significant traction since its launch in January 2021. The app offers a more comprehensive range of features than Mint, including budgeting tools, investment tracking, and financial planning.

According to Ozzie Osman, co-founder of Monarch Money, the company is seeing a significant surge in new customers since Intuit announced the discontinuation of Mint. "We’re getting twice the number of users since the news broke," Osman said via email. "It’s all coming from this."

Why Monarch Money Is Gaining Traction

Monarch Money’s success can be attributed to its innovative business model, which is subscription-based and provides a more comprehensive range of features than Mint. The app also allows users to import their data from other financial apps, making it an attractive option for those looking for a more robust personal finance solution.

In an email interview with TechCrunch, Val Agostino, co-founder of Monarch Money, explained that the company’s goal is to help customers create financial goals and a path to achieve them. "When we started Monarch, my goal was to ‘fix’ many of the things I felt were broken at Mint," Agostino said. "The biggest was the business model. A free personal finance app is simply not a viable business due to the high costs required for financial data aggregation."

Competition in the Fintech Space

The discontinuation of Mint has opened up opportunities for other fintech startups, including Cheddar, a spend tracking app co-founded by Shawn Adrian. According to Adrian, Intuit’s decision to discontinue Mint is a "golden opportunity" for competitors.

However, Monarch Money appears to be gaining the most momentum in the wake of Mint’s discontinuation. The company’s subscription-based model and comprehensive range of features make it an attractive option for those looking for a more robust personal finance solution.

Conclusion

The discontinuation of Mint has sent shockwaves through the fintech industry, with some startups seeing an opportunity to capitalize on the situation. Monarch Money is one such startup that appears to be gaining significant traction since its launch in January 2021.

With its innovative business model and comprehensive range of features, Monarch Money is well-positioned to become a major player in the personal finance space. As the fintech industry continues to evolve, it will be interesting to see how other startups respond to the competition and whether they can replicate Monarch’s success.

Related News