As the U.S. stock market continues to experience modest gains, investors are on high alert for opportunities amidst fluctuating tech stocks and rising interest rates. One way to navigate these dynamic market conditions effectively is by identifying stocks that might be priced below their estimated value.

In this article, we will delve into the top 10 undervalued stocks based on cash flows in the United States. We will explore the current price, fair value (estimated), discount (estimated), and recent developments for each company.

Name | Current Price | Fair Value (Estimated) | Discount (Estimated)

| Clear Secure (NYSE:YOU) | $26.95 | $53.03 | 49.2% |

| Dime Community Bancshares (NasdaqGS:DCOM) | $31.14 | $61.62 | 49.5% |

| Burke & Herbert Financial Services (NasdaqCM:BHRB) | $59.82 | $117.93 | 49.3% |

| Afya (NasdaqGS:AFYA) | $14.88 | $29.32 | 49.3% |

| Lamb Weston Holdings (NYSE:LW) | $63.05 | $125.18 | 49.6% |

| Ally Financial (NYSE:ALLY) | $36.21 | $71.66 | 49.5% |

| HealthEquity (NasdaqGS:HQY) | $97.10 | $189.22 | 48.7% |

| Mr. Cooper Group (NasdaqCM:COOP) | $94.43 | $187.71 | 49.7% |

| Progress Software (NasdaqGS:PRGS) | $65.01 | $128.87 | 49.6% |

| South Atlantic Bancshares (OTCPK:SABK) | $15.69 | $30.76 | 49% |

For a comprehensive list of 170 stocks from our Undervalued US Stocks Based On Cash Flows screener, please click here.

Okta

Overview

Okta, Inc. operates as an identity partner both in the United States and internationally, with a market cap of approximately $13.84 billion.

Operations

The company generates revenue of $2.53 billion from its Internet Software & Services segment.

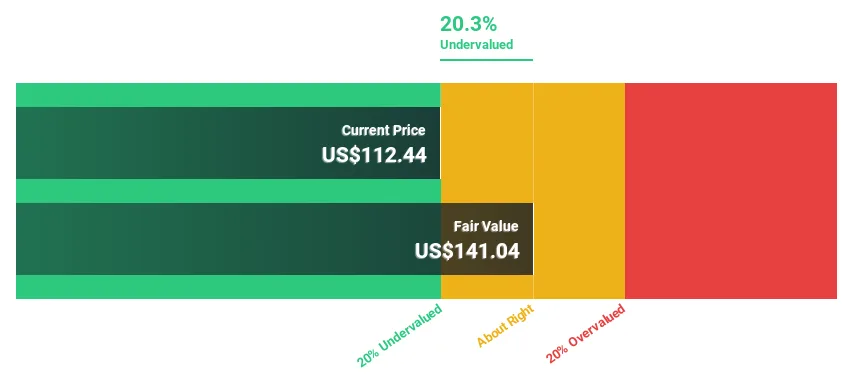

Estimated Discount To Fair Value

40.5%

Okta is trading at US$84.38, significantly below its estimated fair value of US$141.8, suggesting potential undervaluation based on cash flows. Recent earnings show a shift to profitability with net income of US$16 million for Q3 2024 compared to a net loss in the same period last year. The company’s revenue growth rate is also impressive, at 44.5% YoY.

Our comprehensive analysis raises the possibility that Okta is poised for substantial financial growth in the coming years. To discover more about this exciting opportunity, please click here to explore our detailed financial health report.

ZS

Overview

Zscaler operates as a cybersecurity company, with a market cap of approximately $5.33 billion.

Operations

The company generates revenue of $1.11 billion from its cloud-based security services segment.

Estimated Discount To Fair Value

52.3%

Zscaler is trading at US$64.21, significantly below its estimated fair value of US$134.53, suggesting potential undervaluation based on cash flows. Recent partnerships with Nokia and Cognizant enhance Zscaler’s security offerings and expand its market reach, potentially reinforcing its position in the cybersecurity sector amidst evolving threats.

Our analysis raises the possibility that Zscaler is poised for substantial financial growth in the coming years. To discover more about this exciting opportunity, please click here to explore our detailed financial health report.

ROKU

Overview

Roku operates as an American consumer electronics company, with a market cap of approximately $23.35 billion.

Operations

The company generates revenue of $2.62 billion from its streaming media player and advertising segments.

Estimated Discount To Fair Value

44.8%

Roku is trading at US$144.59, significantly below its estimated fair value of US$262.93, suggesting potential undervaluation based on cash flows. Recent partnerships with leading content providers enhance Roku’s streaming offerings and expand its market reach, potentially reinforcing its position in the rapidly growing streaming media sector.

Our analysis raises the possibility that Roku is poised for substantial financial growth in the coming years. To discover more about this exciting opportunity, please click here to explore our detailed financial health report.

Get Started Today

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Discover a world of investment opportunities with Simply Wall St’s free app and access unparalleled stock analysis across all markets.

Contemplating other strategies? Explore high-performing small-cap companies that haven’t yet garnered significant analyst attention. Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence. Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation.

We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Note: The information provided is for general purposes only and should not be considered as personalized investment advice.